Presented by Jones Partners

(Statistics obtained from ASIC website)

© Australian Securities & Investments Commission

Corporate Insolvency Trends

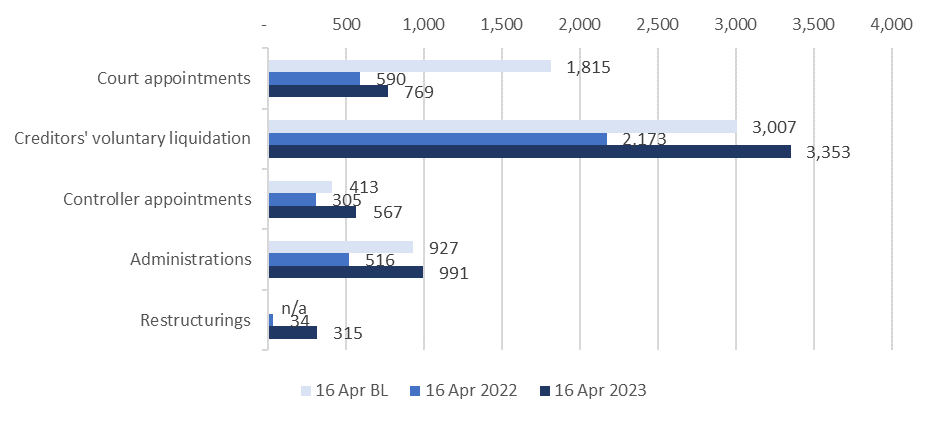

The above statistics show a comparison in 2022, 2023 and base line (2017, 2018, 2019) highlighting the total numbers of administrations and controller appointments.

Court Appointments: In our last update, court appointments were at 490 (as of 29th January 2023). As of 16th April, there are a total of 769 court appointments. This is a significant increase and can be explained by the increasing efforts by the ATO to reclaim outstanding tax debt that was allowed to build up during the pandemic. There has also been a significant increase in the issuing of DPNs (Director Penalty Notices). Total numbers remain far below baseline.

Creditors’ Voluntary Liquidation: Creditors’ voluntary liquidations continue to rise, exceeding the pre-pandemic baseline. They remain the most common insolvency procedure, and we predict this statistic will continue to increase further into 2023.

Controller Appointments: Controller appointments continue to increase, exceeding the baseline.

Voluntary Administrations: Voluntary Administrations in the 2023 FY remains slightly ahead of baseline. Jones Partners predicts they will continue to overtake baseline numbers over the coming months.

Restructurings: Despite a slow uptake, the number of restructurings has exceeded 315, a significant increase from the previous 180 total as of 29th January 2023. The Small Business Restructuring Process (SBRP) has proved effective in assisting businesses and their creditors in obtaining small scale, commercially viable alternatives to the more expensive voluntary administrations. The growing numbers can also be explained by the increased effort by the ATO to chase up outstanding debt, as they are usually the largest creditor. The ATO remains collaborative in the implementation of a SBRP.

Conclusions

- Cases of insolvency have recovered from pre-pandemic levels (but for court appointments), and will likely continue to rise, well exceeding the baseline.

- The ATO continues to adopt a proactive approach to debt recovery. They also remain cooperative, provided businesses have complied with the necessary notices and requirements, and are commercially viable.

- Jones Partners predicts a short-term spike in cases of insolvency over the coming months before the economy returns to regular insolvency levels.