Presented by Jones Partners

(Statistics obtained by ASIC website)

© Australian Securities & Investments Commission

Corporate Insolvency Trends

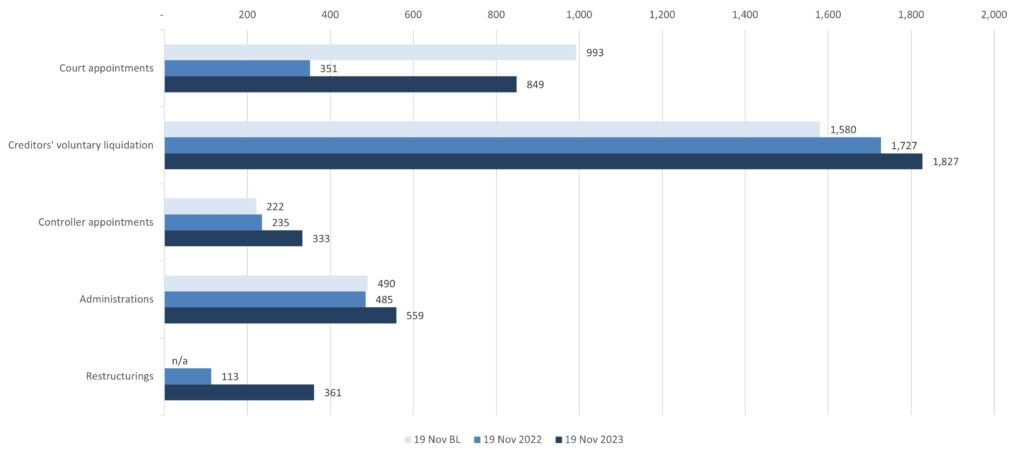

The above statistics show a comparison between 2022, 2023 and base level (the average of 2017, 2018, 2019), highlighting the total numbers of administrations and controller appointments from the 1st July to the 19th November.

Court Appointments: Court appointments have significantly increased since our last update and have nearly returned to base level. A large number of DPNs (Director Penalty Notices) issued during the pandemic have expired, and the ATO has finally adopted a more proactive approach to debt recovery through the courts.

Creditors’ Voluntary Liquidation: Creditors’ voluntary liquidations continue to rise and exceed the pre-pandemic base level. They remain the most common insolvency procedure.

Controller Appointments: Controller appointments continue to increase, exceeding the base level.

Voluntary Administrations: Voluntary Administrations also continue to exceed the base level.

Restructurings: The popularity of the Small Business Restructuring Process (“SBR”) only continues to increase since their introduction in 2021. They are now widely used, allowing a collaborative approach between business owners and creditors.

Conclusions

- Cases of insolvency have generally returned to pre-pandemic levels and are now exceeding the base level statistics. Court appointments have yet to overtake the base level, but they are rapidly increasing. They will likely exceed the base level in the early months of 2024.

- The current economic climate and the debt recovery approach adopted by the ATO is placing increased pressure on companies.

- As economic growth continues to slow, cases of insolvency will continue to increase.

- Cases of corporate insolvency will continue to increase into 2024.

Keen to read more? See our insights on personal insolvency statistics