Presented by Jones Partners

(Statistics obtained from AFSA Website)

June 2023 Totals

- 501 Bankruptcies

- 392 Debt Agreements

- 7 Personal Insolvency Agreements

- 1 Deceased Estate

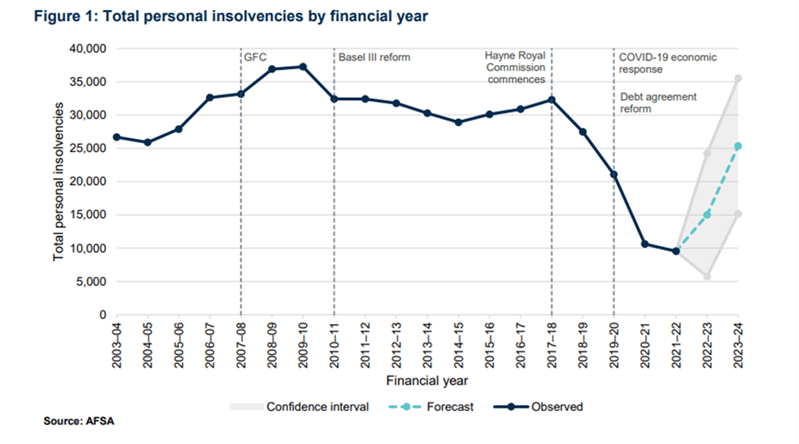

Personal Insolvency Trends

Personal insolvency statistics for June declined slightly from the previous month, which had recorded a total 625 bankruptcies. The most common industries for affected individuals were construction, accommodation, food services and retail trade. This is indicative of the continued supply chain issues and declining profits (which have particularly impacted the food service and construction industry), and the change in consumer behaviour, as customers move away from these non-essential services under increasing cost of living pressures.

Reasons for Delay in Numbers

- Despite a large number of DPN (Director Penalty Notices) being issued (and expiring), the ATO was still not proactively pursuing debt in June. If no action is taken by the director, a DPN can impose personal debt liability for corporate failure and can cause a significant increase in personal insolvency statistics.

- Economic growth, despite having slowed, remained positive and unemployment remained low. Despite interest rates being high, individuals are restricting their spending in response to this “tightening”. This decline in consumer spending will hopefully prevent a rise in loan defaults and spike in personal insolvencies.

Final Conclusions

Its undeniable that the personal insolvency “armageddon” that many postulated has failed to materialise at the end of the 2023 financial year. However, as stated in previous newsletters, an increase in personal insolvencies will come, but we are currently still experiencing the time lag effect. The events of the pandemic were utterly unprecedented, and its impact will continue to unfold for many years.